So, you are sitting on a mountain of hotel points or credit card rewards and wondering, “What points transfer to United?” Then you are in the right place. United Airlines’ MileagePlus program is one of the most flexible and user-friendly airline loyalty programs available anywhere in the world. But here’s the secret method: You don’t have to fly United or even earn miles through them to build up your balance.

Thanks to a robust network of hotel programs, credit card partnerships, and airline alliances, there are plenty of ways to move points into your MileagePlus account. In this guide, we’ll break down what points transfer to United, which transfers are worth it, and how you can turn rewards into free flights without breaking a sweat—or your budget.

Hotel Programs That Transfer to United

Let’s start with the hotel chains. While transferring hotel points to airlines isn’t always the best value, sometimes it’s just what you need to top off your United balance and book that dream trip. Here’s what’s on the table:

Marriott Bonvoy

Transfer Ratio: 3:1.1

Marriott Bonvoy is United’s most valuable hotel transfer partner. For every 60,000 Marriott points your transfer, you’ll get a 5,500-mile bonus—netting you 27,500 United miles. That’s enough for a short-haul one-way flight or a great discount on a longer one. It’s not a 1:1 ratio, but it’s respectable.

IHG One Rewards

Transfer Ratio: Varies (and not in your Favor)

While it’s technically possible to transfer IHG points to United, the ratio is so lopsided you’ll feel like you traded a gold bar for a paper clip. Use this only as a last resort.

Hilton Honors

Transfer Ratio: 10:1

Yes, you can. Should you? Only if you’re desperate or enjoy lighting value on fire. Hilton’s 10:1 ratio is one of the least efficient ways to earn United miles, so we’d recommend holding off unless you’ve got excess points collecting dust.

World of Hyatt

Transfer Ratio: 2.5:1

Hyatt allows transfers to United, but the conversion rate is pretty weak. Still, in a pinch, this can be useful to top up your account for a specific redemption.

Wyndham Rewards

Transfer Ratio: 6,000 Wyndham = 1,200 United

If you love road trips and budget hotels, you might have a stash of Wyndham points. You can transfer them to United, but you’ll lose a good chunk of value along the way.

Airline Programs That Transfer or Redeem with United

If you’re a frequent flyer of other airlines—or if you’ve earned miles through travel partners—you may be able to transfer or use those miles to book flights on United.

Air Canada Aeroplan

While you can’t transfer Aeroplan points directly to United, you can use Aeroplan to book United flights since both airlines are part of Star Alliance. Sometimes, Aeroplan even offers better availability or lower fees—worth a peek.

Virgin Australia Velocity

Velocity points can be transferred to United under specific promotions or booking partnerships. It’s not a regular feature but keep your eye out—especially if you’re in the South Pacific region.

Other Star Alliance Partners

United doesn’t allow direct transfers from Lufthansa, Singapore Airlines, ANA, etc., though they are redeemable on United in exchange for points. This is akin to booking a seat for oneself at a friend’s table without a prior phone call.

Credit Card Programs That Transfer to United

Now we’re talking power moves. If you’ve been swiping and racking up credit card points, this is where you can start to see serious redemption potential.

Chase Ultimate Rewards

Transfer Ratio: 1:1

Chase is United’s top-tier credit card transfer partner. If you have the Chase Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred, you can transfer points directly to United at a perfect 1:1 rate.

This is one of the best ways to accumulate United miles quickly—especially with generous sign-up bonuses and 3x to 5x point categories.

Bilt Rewards

Transfer Ratio: 1:1

Paying rent just got cooler. With the Bilt Mastercard, you can earn points on rent payments (with no fee!) and transfer them to United at a 1:1 ratio. It’s the only card that lets you do this—and for anyone who rents, this is a total game changer.

Marriott Bonvoy Credit Cards

Mentioned earlier under hotel programs, but worth highlighting here again. The co-branded cards make it easy to rack up Bonvoy points and unlock transfer bonuses to United when you’re ready.

Do Amex, Capital One, or Citi Points Transfer to United?

Ah, the million-mile question.

American Express Membership Rewards

Amex points do not transfer directly to United. But don’t give up just yet! You can use Amex points to transfer to Star Alliance partners like Singapore Airlines or ANA, then book United flights through those programs. It’s a detour—but sometimes worth the trip.

Capital One Mile

Same story—no direct transfer to United. But again, you can go through one of the partner airlines in the Star Alliance network.

Citi ThankYou Points

Currently, there’s no direct path to United through Citi. But you can still redeem those points for travel with partner airlines that do fly United routes.

Best (and Worst) Value Transfers

| Source | Transfer Ratio | Worth It? |

| Chase UR | 1:1 | ⭐⭐⭐⭐⭐ |

| Bilt Rewards | 1:1 | ⭐⭐⭐⭐ |

| Marriott Bonvoy | 3:1.1 (+bonus) | ⭐⭐⭐ |

| Hilton Honors | 10:1 | ⭐ |

| IHG / Hyatt | Varies | ⭐⭐ |

| Wyndham | 6,000 = 1,200 | ⭐⭐ |

Just because you can transfer doesn’t mean you should. If you’re chasing efficiency, Chase and Bilt are your MVPs. Marriott is a solid role player. The others… maybe just cheer from the bench.

So, What Points Transfer to United?

If you’ve been asking “What points transfer to United?”, the answer is: a lot of them, but with varying degrees of value.

- Use Chase or Bilt for 1:1 transfers and max value.

- Consider Marriott if you have a big Bonvoy stash—especially with transfer bonuses.

- Avoid low-value transfers unless you’re a few miles away from a dream trip.

Be strategic, and you’ll be boarding your next flight using points faster than you can say “Upgrade to Business Class, please.”

Need Help Transferring or Converting Points?

Let Us Help You Get the Most from Your Points

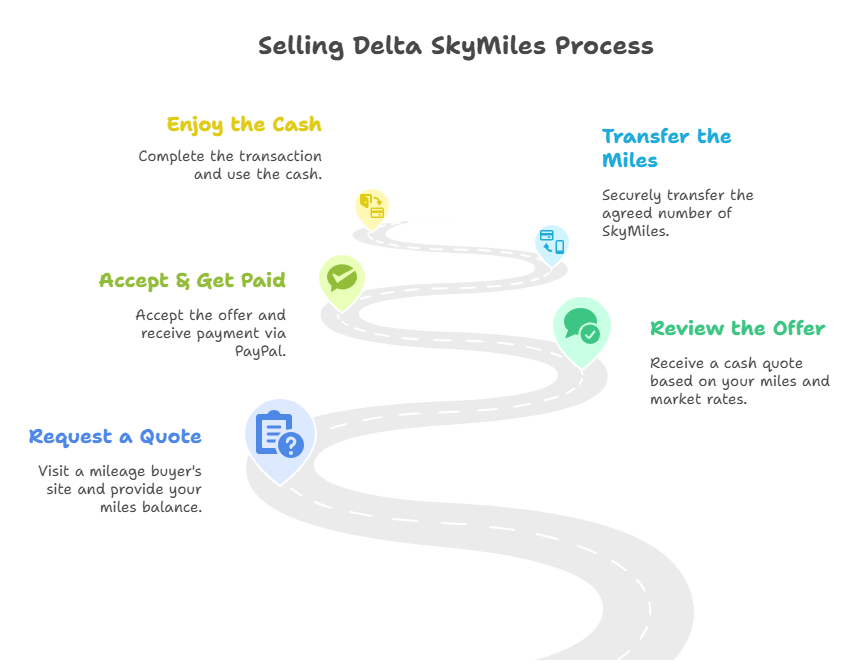

At Cash for miles, we don’t just help you earn more—we help you get more. If you’re holding onto rewards from Amex, Marriott, or others and want to sell airline miles or points for cash, we’ve got your back. We offer a safe, secure, and transparent process with competitive rates—no fine print, no-nonsense.

Need help figuring out how to transfer your points, or just ready to turn them into money in your pocket? Reach out to our friendly team. You earned those points. Let’s make them work for you.