- How Many Amex Points Do You Earn per Pound—and Are They Worth It?

- The General Rule of Thumb

- Variations by Card and Spending Categories

- The International Angle

- The Not-So-Fun Part: Exclusions

- What Are Amex Points Worth?

- Do Amex Points Expire?

- Why Some People Choose to Sell Their Points

- Turning Points into Real Value

How Many Amex Points Do You Earn per Pound—and Are They Worth It?

If you’ve ever even just been a potential card member of American Express, you might be noticing a few points being stacked on your statement. They sound cool, to be honest, but the million-dollar question is: How many Amex points per pound spent, and are they worth it?

The reality is that not every card accumulates points the same way. Some cards grant you points on whatever purchases you make on a day-to-day basis from scratch, whereas others grant bonus points only in select categories. Let us crack the code for you and let you know how much you are getting for every pound you spend-and how those points can go further for you.

The General Rule of Thumb

Most Amex cards in the UK keep it simple: 1 Membership Rewards point for every £1 spent on eligible purchases. It’s straightforward, reliable, and easy to track. If you spend £500, you’ve just earned 500 points. No math degree required.

But of course, this is Amex we’re talking about, and they love adding a twist or two.

Variations by Card and Spending Categories

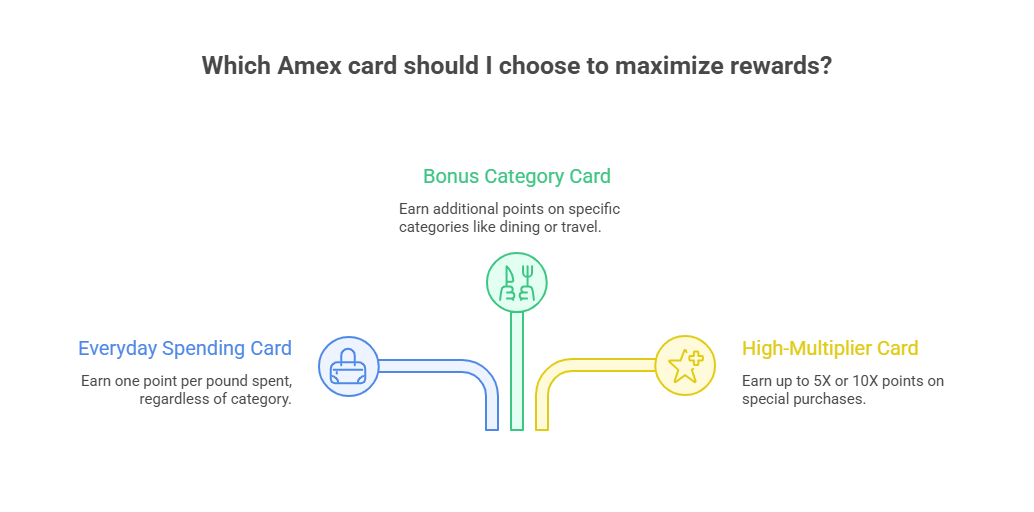

Different Amex cards offer different earning rates, and some go beyond the flat 1-point-per-pound structure.

- Everyday Spending Cards: In general, one point is scored for spending every £1, regardless of categories.

- Bonus Category Cards: Some cards allow you to earn additional rewards points for things like dining, travel bookings, or shopping at select merchants. Suddenly, your Friday night dinner is not just working the dinner-cash-cash path but is somehow working for the rewards account as well.

- High-Multiplier Cards: In some cases, you can earn up to 5X or even 10X points on special purchases. It’s not quite hitting the lottery, but it does make your spending feel a little more rewarding.

Plain and simple, how much you earn depends on the type of card you hold and how closely your spending aligns with reward categories.

The International Angle

When spent outside the UK, the earning rates can look a little different. Some cards, for instance, award 1 point for every 50 INR spent, which roughly translates to 1 point for 47 pence. Some other cards multiply points when used with various online shopping or food delivery platforms.

Here, the key to remember is that the basic principle remains: an average purchase yields a certain number of points, while certain sectors or merchants upgrade the earning rate.

The Not-So-Fun Part: Exclusions

Now, before you start calculating how quickly your points will add up, let’s talk about exclusions. Because yes, there are a few.

- Fuel purchases may not always qualify for full rewards.

- Insurance and utility bills often earn fewer points, or none at all.

- Cash withdrawals or balance transfers won’t earn points either.

Think of it this way: Amex is happy to reward you for dinner dates and shopping sprees, but it’s not too enthusiastic about footing the bill for your electricity or car insurance.

What Are Amex Points Worth?

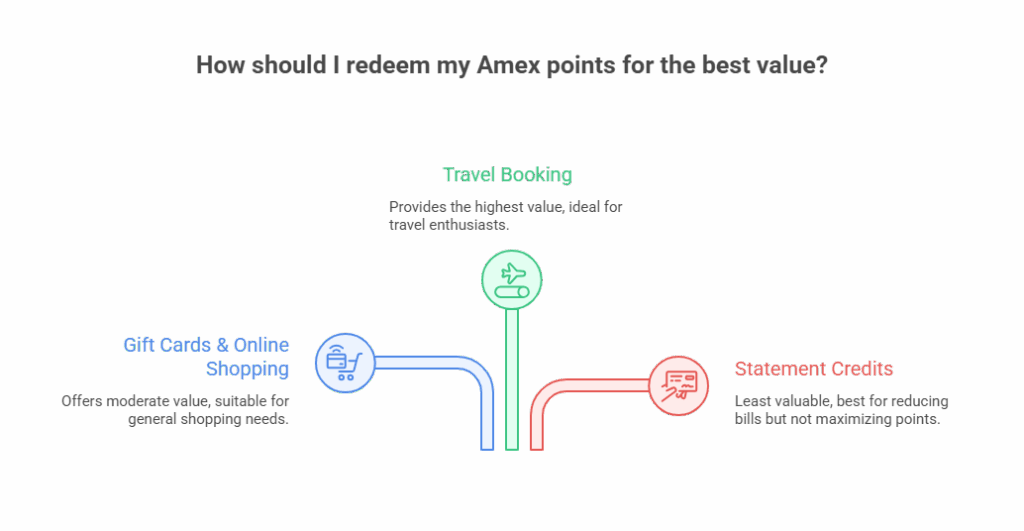

Knowing how many points you get per pound spent is only half the story. The real question is: how much do those points give you back?

- Gift Cards & Online Shopping: About 0.7p to 1p per point. For instance, 1,000 points might get you a shopping credit of about £4.50.

- Travel Booking: Often near the best value—almost 1 cent per point when redeemed for flights or hotels.

That’s when your points start to stretch further.

- Statement Credits: Usually the least valuable option. It works if you just want to reduce your bill, but the value per point is lower—like trading in champagne for sparkling water.

So, while every pound spent is earning you points, the way you redeem them makes a big difference in how much value you get.

Do Amex Points Expire?

Here’s a bit of good news: as long as your account stays open and in good standing, your Amex points don’t expire. That means you can take your time building up a balance without feeling rushed to redeem.

But remember—points don’t grow in value over time. Inflation in the real world often means they’re worth less the longer you wait. Sitting on points for years is like keeping a chocolate bar in the fridge—it’s not going to get sweeter with age.

Why Some People Choose to Sell Their Points

Now, let’s tackle the question that many cardholders eventually ask: What if I don’t want to redeem points for travel or shopping?

That’s where the idea of selling your points comes in. Instead of using them for a limited set of redemptions, you can convert them into real cash.

People choose this route when:

- They’re not planning to travel anytime soon.

- They’d rather have money in hand than another gift card.

- They’ve built up a large balance and want to put it toward something practical—like paying bills or boosting savings.

Learning how to sell American Express points gives you flexibility and freedom. After all, points may look nice on paper, but cash is a lot more versatile.

Turning Points into Real Value

So, how many Amex points per pound spent? The short answer is generally 1 point per £1, with some cards offering bonus categories or higher multipliers. The real value of your points comes from how you redeem them—and for many people, selling their points outright can sometimes be the smartest move.

If your points are just sitting there gathering virtual dust, why not turn them into something tangible? We make it simple, safe, and fast to sell Amex points so you can use your rewards in a way that fits your life.

Because at the end of the day, whether you’re spending pounds or earning points, flexibility is the ultimate reward.