If you’ve ever asked yourself, “What is Brex Rewards?” you’re not alone. In a world filled with loyalty programs, cash-back cards, and enough reward systems to make your accountant sigh, Brex Rewards stands out — mostly because it’s designed with businesses, not individuals, in mind.

At its core, Brex Rewards is the loyalty program tied to the Brex corporate card, which itself is part of a broader fintech platform. Unlike personal credit cards, Brex gears its benefits toward startups, incorporated small businesses, and nonprofits. That exclusivity makes it a little different — and in some ways, more rewarding — than your standard points program. Let’s break it down step by step.

What Is Brex Rewards?

Brex Rewards is a points-based system linked to the Brex corporate card and Brex cash management accounts. It’s not open to just anyone. To qualify, you’ll need an Employer Identification Number (EIN), incorporation paperwork, and a legitimate business structure like an LLC, S-Corp, or C-Corp. Sorry, sole proprietors — this party isn’t for you.

Brex designed this system for companies that spend significantly on categories such as rideshares, travel, and SaaS tools. That’s why it appeals so much to tech startups and fast-scaling businesses. The program isn’t just about earning points — it’s also about integrating with expense tracking, bill pay, and financial controls, making it a more complete business solution.

How Does Brex Rewards Work?

The magic of Brex Rewards comes down to two things: earning and redeeming.

Earning Points

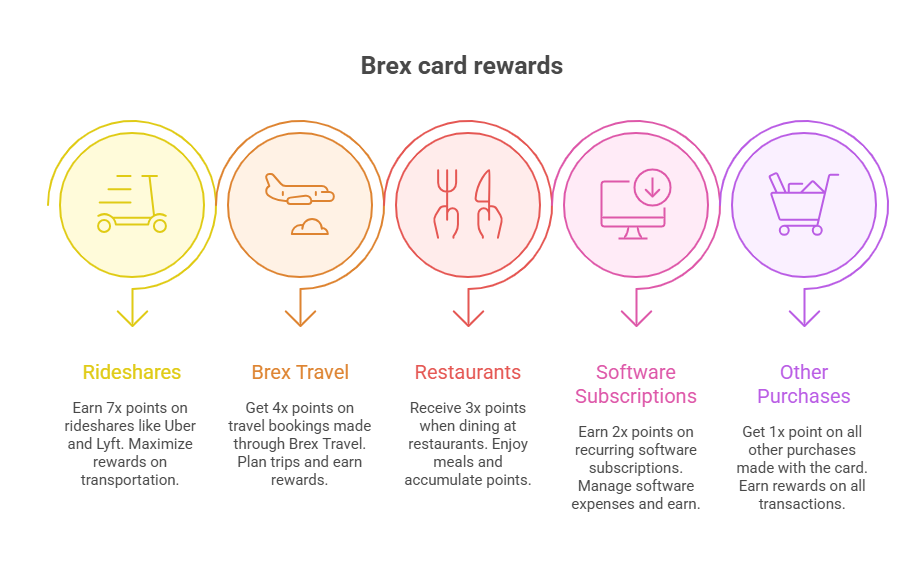

Every swipe of the Brex card earns you something. But unlike flat-rate cards, the Brex system uses a tiered structure based on categories:

- 7x points on rideshares (Uber, Lyft, etc.)

- 4x points on travel booked through Brex Travel

- 3x points at restaurants

- 2x points on recurring software subscriptions

- 1x point on all other purchases

It’s like a reward buffet, except you get more dessert (rideshares) and fewer salads (general purchases).

Brex also sets spending limits differently from traditional banks. Instead of relying only on credit history, your card limit is tied to your Brex Cash account balance or linked corporate bank accounts. This setup works well for startups that may not have years of credit history but do have investor-backed funds or consistent cash flow.

The best part? No annual fees, no foreign transaction fees, and no interest fees. It’s like a card that decided to cut out all the annoying fine print — finally.

Integration with Brex Tools

Brex Rewards isn’t just about swiping a card. The platform integrates with accounting tools like QuickBooks, Xero, and NetSuite, while also offering spend controls, automated bill pay, and unlimited virtual cards for employees. In short, it’s points plus productivity.

How to Redeem Brex Rewards Points

Okay, you’ve earned all these points. Now what? This is where things get interesting — and sometimes a little frustrating.

• Cash Back

You can redeem Brex Rewards as cash back or statement credits, though after a 2023 devaluation, the value dropped to 0.6¢ per point. That means if you were planning to fund your next office pizza party with points, you might need to scale down from “extra cheese” to “please bring napkins.”

• Travel Through Brex Travel

Points hold their full 1¢ value when redeemed for flights or hotels booked through the Brex Travel portal. Bonus: you’ll still earn airline miles on those flights since they count as “paid” tickets. That’s double-dipping in the best way possible.

• Gift Cards

Points may be exchanged for gift cards from high-profile companies like Amazon, Uber, and Airbnb. The drawback? Redemption values are usually similar to cash back values at 0.6¢ per point, so this is more about convenience rather than squeezing value out of it.

• Transfer to Airline Partners

This is where the program shines. Brex partners with airlines like Air France/KLM, Avianca, Cathay Pacific, Emirates, Qantas, Singapore Airlines, and Aeromexico. Transfers occur at a 3:2 ratio, meaning 1,500 Brex points become 1,000 airline miles. It’s not as generous as it once was (a 1:1 ratio before 2023), but with strategic redemptions, you can squeeze more than 1¢ per point of value.

• Cryptocurrency (Previously)

Brex once allowed redemptions for Bitcoin and Ethereum, but this option was quietly removed. Probably for the best — “our business trip is riding on crypto” isn’t something investors love to hear.

Strengths of Brex Rewards

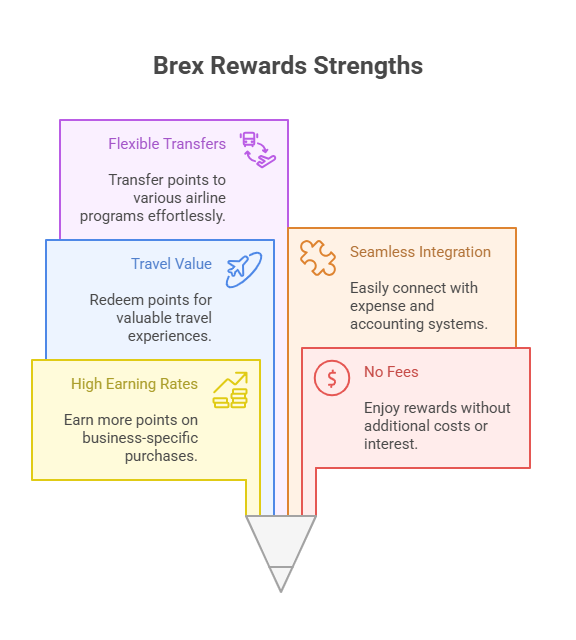

- High earning rates on business-specific categories.

- No fees or interest charges.

- Travel redemptions and transfers offer strong value.

- Integrates seamlessly with expense and accounting tools.

- Flexible transfers to multiple airline programs (including adding users for free).

Limitations and Downsides

- Closed ecosystem: You must open a Brex account to use Brex Rewards.

- Many small businesses don’t qualify due to strict eligibility requirements.

- Devaluation in 2023 reduced the value of cash and gift card redemptions.

- Less appealing for companies without frequent travel or tech-related spending.

Who Should Use Brex Rewards?

Brex Rewards is best suited for fast-growing startups, tech companies, and nonprofits that regularly spend on travel, rideshare, and software. If your business rarely uses those categories, or if you don’t qualify for a Brex account, the program may not offer much value.

Think of it this way: Brex Rewards is like a high-performance sports car. Amazing if you’ve got the right roads (spending categories) to drive it on, but not ideal if you’re mostly running errands around the block.

So, what is Brex Rewards? It’s a powerful points program designed exclusively for businesses that qualify for Brex accounts. While the 2023 devaluation dampened some excitement, it remains a competitive option for companies that can maximize travel redemptions or airline transfers. The key is knowing how — and where — to redeem.

Turning Your Brex Points into Cash

At CashForMyMiles.com, we help you unlock even more value from your Brex Rewards. Why settle for watered-down redemptions when you can sell your Brex points quickly, securely, and for instant cash? We buy Brex Rewards, airline miles, and credit card points — paying you immediately.

Get a quick quote today and see why businesses and individuals alike trust us as the safest, most reliable way to turn points into profit.